2023 Q3 Market Trend Update with Industrial DRAM and Industrial SSD Pricing Outlook

Despite some optimistic estimates on the market downturn trending upward for the second half of the year, the worldwide economy remains sluggish due to inflation and interest-rate hikes. The buying power for ICT products, like mobile phones or notebook computers, is tentative, resulting in weak demand that further worsens memory pricing. The silver lining of this cloudy market is the increasing attention toward AI-related applications that require large amounts of computing power and cloud storage to process data. This segment could drive more growth on industrial servers. Here are some price updates and market outlooks for major applications in the memory market.

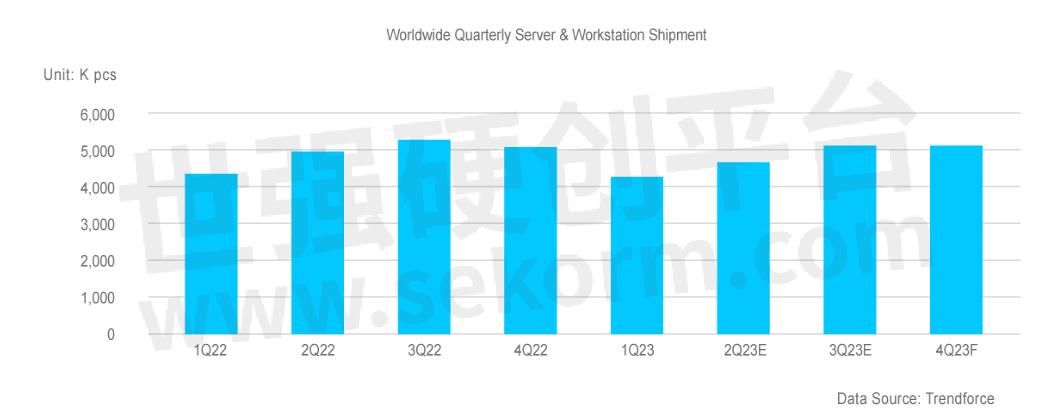

Server Market

More than 5% QoQ reduction in Q2, 23’ server shipments. The overall market remains subdued, with a single-digit decline in revenue during Q3. No obvious factor indicates the increase in shipments.

However, expected recovery could be faster than estimated with a two-digit growth in sales during late Q4, 23’ thanks to robust demand for virtualization, advanced data intelligence, and AI products.

PC/NB Market

The spot price experienced a temporary increase for less than a week at the end of May, primarily due to factors such as production cuts by chip makers and China's ban on specific US chip manufacturers. The impact was more significant in the PC/NB segment, while the server/mobile market remained unaffected.

The quantity of PC/NB DRAM shipments has experienced a 7% decline compared to the previous quarter. The market is still under inventory pressure resulting from mid-stream (NB OEM) and original suppliers. The contract price and spot price have repeatedly intersected since last May and this pattern is expected to persist throughout Q3, 23’.

Mobile Market

SMARTphone shipment quantities have shown gradual signs of recovery in Q2, 23’ with a 7% QoQ increase after a historical low in Q1. However, whether the growth can continue remains uncertain in the upcoming quarter.

The decline in the mobile market was driven by a number of factors, especially ongoing inflation, resulting in delaying or canceling consumers’ device upgrades to their smartphones and tablets.

Q3 Outlook in DRAM

For Server DRAM, a negative sufficient ratio is expected with during late Q3, 23’ as CXL technology benefits memory coherency between the CPU memory space and memory on attached devices. The most attractive factors of the CXL protocol are reducing software stack complexity and lowering overall system cost.

Graphic DRAM may boost the demand in the second half of 2023 as its various support in AI-related applications will benefit the DRAM suppliers in consuming high inventory.

Q3 Outlook in NAND

The slump in both volume and price may lead to global enterprise SSD revenue falling by nearly 50%.

MLC production would decline more than 20% in 2023 compared with last year. pSLC mode on TLC solution would be the cost-effective choice for high-end applications in the server and IPC industry.

Among various applications, enterprise SSD and mobile stand out as the primary and substantial source of bit consumption in Q3, 23’.

*The article was compiled by SMART Modular using data sources from market reports by DRAMexchange & SPOT market reference, Taipei TIMES, BBC, Trendforce, and Digitimes.

- +1 Like

- Add to Favorites

Recommend

- Managing DRAM Supply in the Quarters Ahead

- DRAM: How to Pick the Right Embedded Memory?

- Can Your DRAM Withstand Wide-Temp Operating Conditions?

- Building AI Servers with DRAM for Artificial Intelligence

- Alliance Complete Automotive Temperature DRAM Portfolio, Now With Reduced Lead Times

- Understanding RAM and DRAM Computer Memory Types

- The Road Ahead: DRAM Fueling Automotive Trends

- Alliance Memory Expanded Low-Power SDRAM Portfolio and Offered LPSDR, LPDDR, and LPDDR2 Devices in Wide Range of Densities and Package Options

This document is provided by Sekorm Platform for VIP exclusive service. The copyright is owned by Sekorm. Without authorization, any medias, websites or individual are not allowed to reprint. When authorizing the reprint, the link of www.sekorm.com must be indicated.