The Global Power Device Market Will Grow Rapidly

Driven by applications such as electric and hybrid electric vehicles (xEV), renewable energy, and industrial motors, Yole expects the global power device market to grow to US$33.3 billion by 2028, and Chinese manufacturers will develop rapidly based on the advantages of the electric vehicle industry.

The latest data from Yole shows that the global power device market will rapidly grow from approximately US$23 billion in 2023 to US$33.3 billion in 2028. This demand requires the establishment of more silicon, SiC, and GaN power device manufacturing capacity to support it.

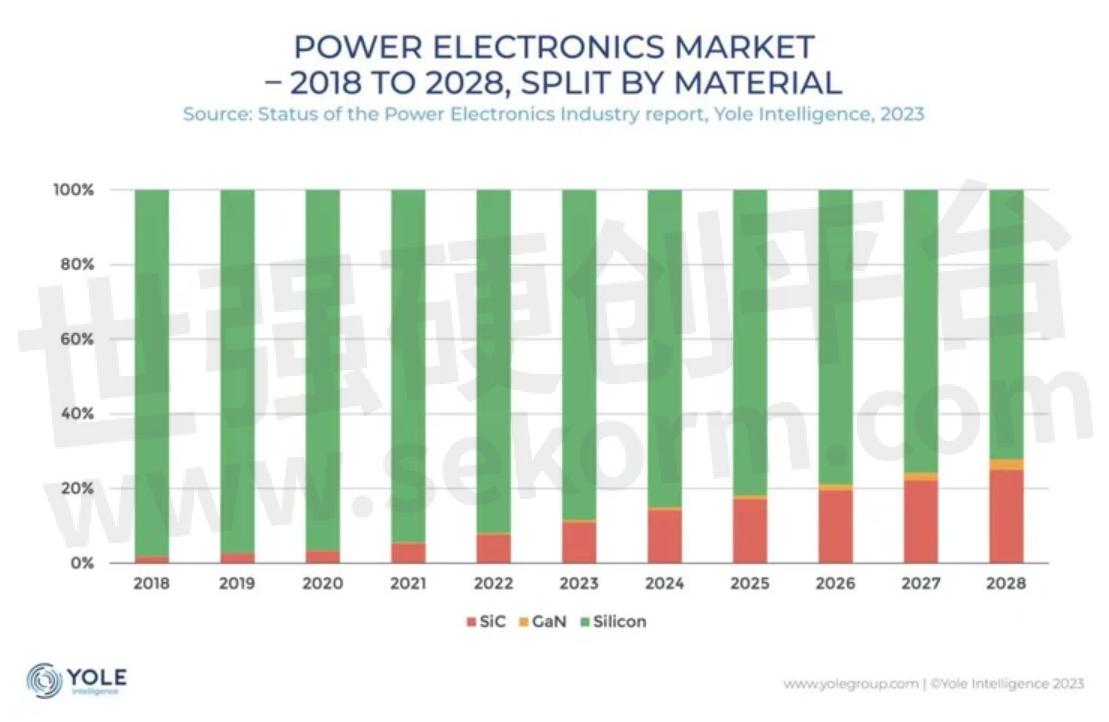

Fig.1

Silicon device manufacturers have been developing and actively embracing the trend of moving to 12-inch wafers to increase production capacity and reduce the cost of a single die. Silicon wafers are also used in other microelectronic devices such as sensors, so investing in 12-inch wafer manufacturing equipment is less risky than transitioning from 6-inch silicon carbide wafers to 8-inch.

Ana Villamor, chief analyst of power electronics at Yole, predicts that in the next five years, based on the current 56 million 8-inch equivalent wafers, the production capacity will increase by 25 million 8-inch equivalent wafers every year. This is a super investment cycle, is also the largest investment cycle in the history of the electronics and power industry.

In the field of SiC power devices, mainly driven by electric vehicles, it is expected that the market size of electronic power devices will reach about 25% by 2028; in the field of GaN power devices, it is mainly driven by the demand for consumer fast charging and smartphones and computer adapters promote. SiC power devices are being adopted in downstream applications faster than GaN, which started later, but both will gain a share from the traditional silicon device market.

As far as SiC devices are concerned, SiC wafer cost and availability have always been the main factors affecting its development speed. There are a large number of vertically integrated manufacturers in the supply chain from wafer to device. Large companies such as Wolfspeed, ON Semiconductor, Rohm, and STMicroelectronics cover the entire supply chain, including ingot/substrate, epitaxy, chip processing, and diode/transistor design; small Chinese companies such as Tianke Heda, and Tianke Yue Advanced focus on the field of SiC ingot/substrate. Some SiC device manufacturers such as Infineon and Bosch rely on external SiC wafer supply. Chinese companies are gradually expanding their market share in the SiC wafer field and plan to significantly increase production capacity in the next five years, with the goal of accounting for the world's total by 2027. More than 40% of production capacity.

Yole expects that Chinese suppliers may supply large quantities at lower prices, and the reversal of the supply and demand situation of SiC wafers will significantly change the rules of the game for the SiC and silicon power device industries. The emergence of cheaper SiC devices will not only affect high-cost SiC Manufacturers but will also accelerate the replacement of silicon devices by SiC devices in many applications.

- +1 Like

- Add to Favorites

Recommend

- ROHM and UAES Sign a Long-Term Supply Agreement for SiC Power Devices

- ROHM‘s New Environmental-friendly Building Helps Expand Production Capacity of SiC Power Devices

- ROHM and Geely Automobile Group Form a Strategic Partnership Focused on SiC Power Devices

- ROHM and BASiC Semiconductor Form a Strategic Partnership,Contributing to The Technical Innovation of New Energy Vehicles through The Development of Automotive Sic Power Devices

- What is SiC and why is SiC for power devices?

- ROHM Recognized as a Preferred Supplier of SiC Power Solutions by UAES

- SiC Device War Is About To Start

- ROHM Offers the Industry’s Largest* Library of LTspice® Models at Over 3,500 by Adding SiC and IGBTs

This document is provided by Sekorm Platform for VIP exclusive service. The copyright is owned by Sekorm. Without authorization, any medias, websites or individual are not allowed to reprint. When authorizing the reprint, the link of www.sekorm.com must be indicated.