SiC Device War Is About To Start

In 2018, German giant Infineon announced that it had acquired a startup called Siltectra and included an innovative technology (ColdSpilt) in its pocket. "Cold cutting" is an efficient crystalline material processing technology that minimizes material loss. Infineon will use this technology for dicing silicon carbide (SiC) wafers, thereby doubling the number of chips that can be produced on a single wafer. Further, increase the silicon carbide market.

Earlier, the CEO of STMicroelectronics also mentioned in an interview with the Semiconductor Industry Watch and other media that the company's silicon carbide products have been shipped in batches, with annual shipments exceeding 100 million US dollars this year and a market share of 90 %; X-Fab also claims to expand wafer production; Japan's Rohm also announced in April this year that it will construct a new plant at its Fukuoka Chikugo factory to expand silicon carbide production capacity.

Various sources of evidence prove that the SiC war is about to begin.

Demand for SiC power devices increases

According to Semiconductor Engineering, SiC is a composite semiconductor material based on silicon and carbon. In the production process, specialized SiC substrates are developed and then processed in a fab to obtain SiC-based power semiconductors. Many SiC-based power semiconductors and competing technologies are specialized transistors that switch the device's current at high voltages. They are used in the field of power electronics and can realize the conversion and control of power in the system.

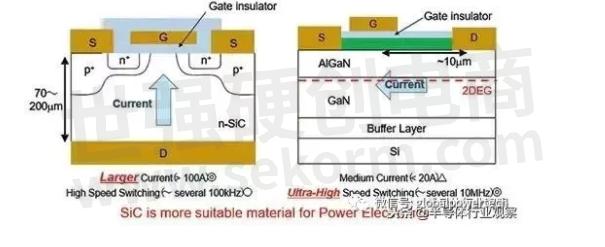

Because of its vertical structure, compared to gallium nitride and silicon, silicon carbide can withstand higher voltages and can be applied to applications above 1000V. In terms of silicon, most silicon-based MOSFETs are currently applied below 1000V, about 600 ~ 900V. If it exceeds 1000V, the chip size will become very large, and the switching loss and parasitic capacitance will increase. The price will also increase greatly, so it is less suitable for applications above 1000V. And SiC stands out because of its wide bandgap technology. Compared with traditional silicon-based devices, the breakdown field strength of SiC is 10 times that of traditional silicon-based devices, and the thermal conductivity is 3 times that of traditional silicon-based devices, which has extremely powerful advantages.

The design methods of SiC and GaN are different, so the degree of withstand voltage is also different.

In an interview with Semiconductor Industry Watch, ROHM also said that in the field of power components, SiC has attracted much attention as a new generation of materials. Compared with traditionally used Si, SiC components achieve low on-resistance, high-speed switching, and high-temperature operation. And the use of SiC components can make the device smaller and lower power consumption. Due to the high-pressure resistance and high heat resistance, it is possible to install in a small space and harsh environment that could not be used before. Taking automobiles as an example, they can be used in hybrid cars and electric cars to greatly reduce fuel consumption and expand indoor space. When used in solar power generation, the power loss rate can be reduced by 50%, which is expected to make a huge contribution to the relief of global environmental problems. This makes this new material device very suitable for various fields such as power supplies, automobiles, railways, industrial equipment, home consumer electronics equipment, and so on. Especially this year, with the development of electric vehicles and other industries, the market demand for SiC has greatly increased.

According to Mymes Consulting, in 2018, there will be more than 20 automakers in the world, using SiC Schottky Diodes or SiC MOSFETs in OBC; SiC power semiconductors are expected to use CAGR in the OBC market 44% growth rate to 2023. Mymes continues to point out that in the future, more and more auto manufacturers will use SiC power semiconductors in the main inverter, especially Chinese car manufacturers. In recent years, they have also considered using SiC power components. Therefore, 2017 ~ In 2023, the CAGR of SiC power components in the main inverter market may be as high as 108%. This is driving explosive market progress.

From the data provided by them, we can see that the global SiC power semiconductor market will grow rapidly from $302 million in 2017 to $1.399 billion in 2023, with a compound annual growth rate of 29%.

Upstream suppliers step up layout

Facing such a growth trend, the upstream supply chain manufacturers of SiC are actively deploying.

First of all, in terms of wafers, currently, only about three or four operators (Cree, Norstel, Nippon Steel & Sumikin, etc.) can provide stable output, but it seems that this field is facing different changes.

First, in the global SiC wafer leader Cree, they accelerated their entry into the automotive field.

In August this year, Wolfspeed, a subsidiary of the company, announced the launch of the new robust SiC semiconductor device family E-Series for the electric vehicle (EV) and renewable energy markets. According to the official introduction, Wolfspeed's E series is the first commercial series of SiC MOSFETs and diodes with PPAP function that meets the automotive AEC-Q101 standard. This product makes it the only commercial SiC MOSFET and diode series that meets high humidity and automotive qualifications, providing the most reliable and corrosion-resistant components for today's power market.

Japanese company Showa Denko has issued multiple SiC production expansion statements in the past year or so.

Showa Denko said that the company previously announced an increase in the production of SiC wafers in September 2017 and January 2018. However, due to the rapid growth of the SiC power control chip market and in response to strong demand from customers, the company decided to invest in SiC wafers. Invest in the third increase in production. Showa Denko's monthly production capacity of SiC wafers was increased from 3,000 to 5,000 in April this year (2018) (the first increase in production), and will be further increased to 7,000 in September this year (the second increase in production). After the third increase in production investment, it will be expanded to a level of 9,000 pieces in February 2019, 1.8 times the current level (5,000 pieces).

In terms of foundries, X-Fab announced in September this year that it plans to double its 6-inch SiC process plant in Texas to meet customers' growing demand for high-efficiency semiconductors. To double the capacity, X-Fab's Texas plant purchased a second heated ion implanter for manufacturing 6-inch SiC wafers. Production is expected to be timely in the first quarter of 2019 to meet projected near-term demand.

"With the increasing popularity of SiC, we have long understood that improving ion implantation capabilities is the key to our continued manufacturing success in the SiC market. But this is just our specific SiC manufacturing process improvement The first step in our overall capital plan. This demonstrates X-Fab's commitment to the SiC industry and maintains our leadership in the SiC foundry business. "

Hestia, a wafer foundry from Taiwan, also announced in August this year that it had decided to expand the capacity of silicon carbide (SiC). The board of directors resolved to invest 340 million yuan to build a new 6-inch SiC production line, making it the first in Taiwan to expand SiC. The capacity of the foundry is expected to start trial production in the second half of next year. It is understood that Han Lei has now established a monthly production capacity of about 1500 for a 4-inch SiC process. It is expected that some of the existing 6-inch wafer fab production lines will be changed to SiC process production lines. The process will be established first to meet the strong customer demand for automotive and industrial control products Demand because the price of 6-inch SiC reaches 4,000 US dollars (about 120,000 Taiwan dollars), it is estimated that as long as the output of 2,000 to 3,000 pieces per month, driving revenue is expected to increase by more than 200 million yuan.

In terms of domestic production, some players are eager to try.

According to public information, in May this year, Shanghai Junxin Electronics claimed that the first domestically produced 6-inch silicon carbide (SiC) MOSFET wafers they made were officially launched. According to reports, the company was officially registered and established in Shanghai Lingang Science and Technology City on July 17, 2017; completed the process flow, device and layout design in early October 2017, and completed preliminary process tests between October and December; and from Formal tape-out began in December 2017. In less than 5 months, it has overcome various difficulties and successfully completed the manufacturing process of silicon carbide (SiC) MOSFETs on a mature 6-inch process production line. The wafer-level test results show that various electrical parameters meet expectations, laying a solid foundation for further optimization of process and device design.

Beijing Tanke Blue, established in 2006, claims to be the pioneer of silicon carbide wafer manufacturing in the Asia-Pacific region.

According to their official website, Beijing Tanke Blue realized the industrialization of silicon carbide crystals for the first time in China, breaking the long-term foreign technology blockade and monopoly, and supplying wafers (including semi-insulating, conductive, Along the c-axis and off-angle, etc.), promoted basic research on silicon carbide epitaxy and devices, and brought more than 20 (including 5 newly established) companies such as CSR Group into downstream epitaxial, device and module industries, forming a domestic complete industrial chain has been promoted the development of China's wide bandgap semiconductor industry.

Hantian Tiancheng is another China-US joint venture high-tech enterprise focusing on silicon carbide epitaxial wafers. According to DigiTimes, it relies on top R & D technical teams composed of mainland China, the United States, and Japan. Since its establishment in 2011, the company has formed three-inch, four-inch, and six-inch complete silicon carbide semiconductor epitaxial wafer production lines, and has met the needs of 600V, 1200V, and 1700V device manufacturing. The company is also the first domestic supplier of commercial 6-inch silicon carbide epitaxial wafers. The company is expected to complete the land construction of the second phase of the plant by the end of this year and gradually release new capacity in the first half of next year. The second-stage expansion is expected to achieve a tenfold increase in production capacity, and the annual production capacity of 300,000 wafers will be achieved.

These domestic and foreign upstream manufacturers are promoting the further development of the SiC industry.

Scramble for downstream chip fabs

In order to better grasp the opportunities that are about to erupt, downstream chip factories have also increased their card slots.

Taking Infineon as an example, in February this year, Infineon Technologies AG and Cree signed a strategic agreement for the long-term supply of silicon carbide (SiC) wafers. According to Infineon CEO Reinhard Ploss: "We have known Cree for a long time. It is a strong and reliable partner and enjoys a good reputation in the industry. With this long-term silicon carbide wafer supply agreement, we can enhance our strengths in strategic growth areas such as automotive and industrial power control to create greater value for our customers. "This is to ensure Infineon's strong support before volume shipments of SiC.

As for the Siltectra acquisition, Infineon made a decision to provide SiC chip production. According to reports, the Cold Split developed by the company can effectively handle crystalline materials and significantly reduce material loss. Infineon will use this Cold Split technology to split silicon carbide (SiC) wafers to double the number of chips produced by the wafers. Infineon CEO Reinhard Ploss also said, "This acquisition will help us expand our outstanding product portfolio with the new material silicon carbide. Our knowledge of the system and our unique expertise in thin wafers will be combined with Cold Split technology and Siltectra Innovation capabilities complement each other. Cold Split technology helps us to mass-produce SiC products with more SiC wafers, further expand in renewable energy, and promote the use of SiC in electric vehicle transmission systems. "

Yu Daihui, vice president of Infineon's industrial power control department and vice president of Greater China, also said in an interview with the semiconductor industry in the past that Infineon's research on SiC has been more than fifteen years, and it has invested more in recent years. 35 million euros for R & D of SiC equipment and related processes, and established a reliable cooperative relationship with reliable 6-inch SiC wafer suppliers to ensure the supply of their SiC wafers; coupled with their top R & D and technology With the support of the support team, Infineon's SiC research and development progressed smoothly, and the CoolSiC series products were launched.

Coming to Rohm, another important player of SiC, as a new material for power components, Rohm has been concerned about SiC for a long time, and has cooperated with users and universities and other institutions to continuously accumulate technical experience. According to them, after the German SiCrystal company, which specializes in SiC materials, was incorporated in 2009, the company established a vertically integrated production system, which also made the company the only SiC manufacturer in the world that can achieve one-stop production. We have carried out quality improvement activities in all processes from wafer to packaging.

In April 2010, Rohm also took the lead in the mass production of SiC diodes in Japan. In December of the same year, the world's first mass-production system for SiC transistors was established. In March 2012, the world's first mass production of full SiC power modules began. Currently, ROHM has achieved mass production of the third-generation SiC MOSFET and SiC SBD products. Recently, a new product of 1700V 250A full SiC power module was launched. At the same time, Rohm leverages the advantages of comprehensive semiconductor manufacturers to provide control ICs that take advantage of the excellent performance of SiC components, as well as evaluation and simulation tools that support customers' use environments. Therefore, we can provide customers with comprehensive power solutions led by advanced SiC power components. In an interview with Japanese media earlier this month, Rohm said that he hoped to increase its market share to 30% by 2025.

As for STMicroelectronics, because its SiC products are adopted by global electric car star Tesla, their performance in this market cannot be ignored. And at the beginning of the article, we also talked about their CEO's introduction to their current situation. According to the company's official website, STMicroelectronics has been engaged in the research and development of silicon carbide technology since 1996. Launching a new technology in the semiconductor market, high quality, long life, and cost competitiveness are the basic requirements. STMicroelectronics overcame the mass production challenge of this wide bandgap material and began production of its first SiC diode in 2004. In 2009, ST's first SiC MOSFET was put into production. Since then, 1200V SiC MOSFETs and power Schottky diodes have been added to complete the original 650V product portfolio.

As market competition intensifies and the cost of basic materials continues to decrease, the supply chain of silicon carbide has become more and more robust. STMicroelectronics has been working to improve material and process quality. As materials and SiC-based products become more mature, STMicroelectronics has developed automotive-grade SiC power devices that are becoming a key driver of automotive electrification.

ST's 6-inch silicon carbide wafers were put into production in 2017. The expansion of production scale will help reduce chip costs, increase market supply, and meet the increasing demand for SiC applications (including more solar inverters, industrial motors drives, appliances, and power adapters).

Other companies such as ON Semiconductor, Toshiba, Fuji Electric, Mitsubishi, Littelfuse, General Electric, and GeneSiC are also important players in the SiC market. They are all gearing up and waiting.

Need to cross these hurdles

No matter from the market reaction or the performance of the company, it seems that SiC devices have really reached the time of its outbreak, but on the whole, it still needs to cross several hurdles. First, according to Rohm, SiC is more expensive than Si. How to improve cost competitiveness is a key condition for SiC to break out.

Technically, SiC also needs to meet several challenges.

Sima Liangliang, the vice president of sales of Hantian Tiancheng Electronic Technology, said in an interview with Taiwanese media CTIMES that because the bottleneck of silicon carbide production has not been resolved and the quality of the raw material crystal pillars is unstable, the overall market cannot be popularized on a large scale. Another development limitation is the application and design of silicon carbide components. Sima Liangliang said that because silicon wafers have been around for a long time, and they have been around for many years, they have very complete tools and technical support, so most chip engineers are only familiar with the chip development of silicon components. The purpose is not very clear.

He even used "Doctors" and "Primary School Students" to compare the current knowledge gap between silicon crystals and silicon carbide. Because of this knowledge gap, the development of silicon carbide components is slower.

"Engineers are not very clear about the performance of silicon carbide components, coupled with the instability of wafer quality, which leads to insufficient yield and reliability of components, which makes the entire industry develop very slowly," said Sima Liangliang.

If these problems can be solved one day, the era of SiC will really come.

- +1 Like

- Add to Favorites

Recommend

- ROHM and UAES Sign a Long-Term Supply Agreement for SiC Power Devices

- ROHM‘s New Environmental-friendly Building Helps Expand Production Capacity of SiC Power Devices

- ROHM and Geely Automobile Group Form a Strategic Partnership Focused on SiC Power Devices

- ROHM and BASiC Semiconductor Form a Strategic Partnership,Contributing to The Technical Innovation of New Energy Vehicles through The Development of Automotive Sic Power Devices

- What is SiC and why is SiC for power devices?

- ROHM Recognized as a Preferred Supplier of SiC Power Solutions by UAES

- ROHM Offers the Industry’s Largest* Library of LTspice® Models at Over 3,500 by Adding SiC and IGBTs

- Global Power Technology Successfully Passed “DNV And USCG Certification“

This document is provided by Sekorm Platform for VIP exclusive service. The copyright is owned by Sekorm. Without authorization, any medias, websites or individual are not allowed to reprint. When authorizing the reprint, the link of www.sekorm.com must be indicated.