Renesas Announces Consolidated Forecasts and Forecasts of Cash Dividends

Renesas Electronics Corporation (TSE: 6723), a premier supplier of advanced semiconductor solutions, today announced the consolidated financial forecasts and forecasts of cash dividends for the full year ending December 31, 2021.

The Group reports its consolidated forecasts for the full year as a range because of the difficulty of forecasting results with high accuracy due to the short-term volatility of the semiconductor market.

Additionally, in order to provide useful information to better understand the Group’s constant business results, figures such as gross margin and operating margin are presented in the non-GAAP format, which excludes or adjusts the non-recurring items related to acquisitions and other adjustments including non-recurring expenses or income from the financial figures based on GAAP (IFRS based) following a certain set of rules. However, the figure provided as revenue is based on IFRS and does not include non-GAAP adjustments.

The revenue forecast is provided assuming the midpoint and the range of the forecast are listed in brackets. The gross margin and operating margin forecasts are given assuming the midpoint in the revenue forecast.

1. Consolidated forecasts for the full year ending December 31, 2021

(January 1, 2021 to December 31, 2021) In millions of yen

Note: Non-GAAP figures are calculated by removing or adjusting non-recurring items and other adjustments from GAAP figures following a certain set of rules. The Group believes non-GAAP measures provide useful information in understanding and evaluating the Group’s constant business results, and therefore, forecasts are provided as a non-GAAP basis. This adjustment and exclusion include depreciation of property, plant and equipment, amortization of intangible assets recognized from acquisitions, other PPA adjustments and stock-based compensation, as well as other non-recurring expenses and income the Group believes to be applicable.

The consolidated forecasts for the full year ending December 31, 2021 are calculated by combining the forecasts for the three months ending December 31, 2021, to the financial results of the nine months ended September 30, 2021. The consolidated forecasts for the full year ending December 31, 2021 are calculated at the rate of 109 yen per USD and 129 yen per Euro.

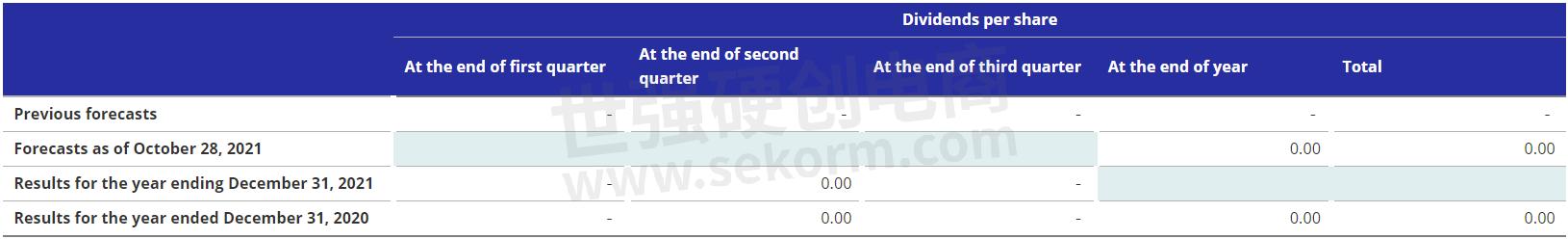

2. Forecasts of cash dividends for the fiscal year ending December 31, 2021

For the full year ending December 31, 2021, the Group suspends year-end dividend payment.

The Group will divert its retained earnings for strategic investment opportunities that will enable the Group to respond to rapid environmental changes in order to thrive in the global marketplace, thus increasing shareholder profit by improving corporate value. Based on a long-term standpoint, the Group aims to realize stable and sustained growth in profits to allow dividends to be reinstated.

About Renesas Electronics Corporation

Renesas Electronics Corporation (TSE: 6723) delivers trusted embedded design innovation with complete semiconductor solutions that enable billions of connected, intelligent devices to enhance the way people work and live. A global leader in microcontrollers, analog, power, and SoC products, Renesas provides comprehensive solutions for a broad range of automotive, industrial, infrastructure, and IoT applications that help shape a limitless future.

Forward-Looking Statements

The statements in this press release with respect to the plans, strategies and financial outlook of Renesas and its consolidated subsidiaries (collectively “we”) are forward-looking statements involving risks and uncertainties. Such forward-looking statements do not represent any guarantee by management of future performance. In many cases, but not all, we use such words as “aim,” “anticipate,” “believe,” “continue,” “endeavor,” “estimate,” “expect,” “initiative,” “intend,” “may,” “plan,” “potential,” “probability,” “project,” “risk,” “seek,” “should,” “strive,” “target,” “will” and similar expressions to identify forward-looking statements. You can also identify forward-looking statements by discussions of strategy, plans or intentions. These statements discuss future expectations, identify strategies, contain projections of our results of operations or financial condition, or state other forward-looking information based on our current expectations, assumptions, estimates and projections about our business and industry, our future business strategies and the environment in which we will operate in the future. Known and unknown risks, uncertainties and other factors could cause our actual results, performance or achievements to differ materially from those contained or implied in any forward-looking statement, including, but not limited to, general economic conditions in our markets, which are primarily Japan, North America, Asia, and Europe; demand for, and competitive pricing pressure on, products and services in the marketplace; ability to continue to win acceptance of products and services in these highly competitive markets; and fluctuations in currency exchange rates, particularly between the yen and the U.S. dollar. Among other factors, downturn of the world economy; deteriorating financial conditions in world markets, or deterioration in domestic and overseas stock markets, may cause actual results to differ from the projected results forecast.

- +1 Like

- Add to Favorites

Recommend

- Renesas DSP Solution on Renesas Lab on the Cloud, Input Analog Signals Directly From A Signal Generator To The Rx231 Microcontroller Evaluation Board

- Renesas‘ Semiconductor Manufacturing Factory (Naka Factory) Fire: Production Capacity Has Recovered to 88%

- Renesas Announces 10 New Winning Combinations Integrating Celeno and Renesas Products

- Renesas & Altran to Deploy First Social Distancing Wristwatch Using Ultra-Wideband Chipset with Low Rate Pulse

- Renesas and FAW Establish Joint Laboratory to Accelerate Development of Next-Generation Smart Vehicles

- Renesas Semiconductor Manufacturing Factory (Naka Factory)‘ Production Level Has Returned to 100%

- Renesas and Sequans Expand Their 5G Collaboration including Broadband IoT Module for 5G NR FR1/FR2

- Renesas and Cyberon Partner to Deliver Integrated Voice User Interface Solutions for Renesas RA MCUs Supporting Over 40 Global Languages

This document is provided by Sekorm Platform for VIP exclusive service. The copyright is owned by Sekorm. Without authorization, any medias, websites or individual are not allowed to reprint. When authorizing the reprint, the link of www.sekorm.com must be indicated.