The Advance of WAYON Domestic IGBT, with higher power cycle life and higher robustness

Under the wave of vehicle electrification, various countries have entered the rapid development period of new energy vehicles. EV talk speculates that global annual sales of new energy vehicles will reach 12 million units in 2025.

In 2020, the Chinese government issued the New Energy Vehicle Industry Development Plan (2021-2035), which proposed:

In 2025, new energy vehicle sales in China account for 20% of total vehicle sales.

In 2025, the average electricity consumption of new pure electric passenger vehicles will drop to 12.0 kWh/100 km.

Annual new energy vehicle sales in 2021, with a higher-than-expected 3.52 million units, increased by 1.6 times year-on-year. Based on this growth rate, the China Association of Automobile Manufacturers (CAAM) has proposed in its 2021 annual report that the year-on-year growth of new energy vehicle sales in 2022 is expected to reach 44% or 5 million units. Thus, the planning target of "China's new energy vehicle sales accounting for 20% of total vehicle sales" is also expected to be reached ahead of schedule.

#1 Importance of IGBT in New Energy Vehicles

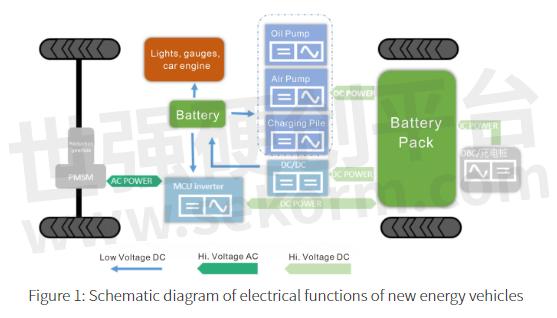

New energy vehicles, meaning vehicles with non-traditional fuel as the power source in the component of the power system. The most obvious feature of all current new energy vehicles is the battery and motor drive system as the vehicle power source. IGBT is the most widely used solution for the motor controller in the motor drive system.

Classification of IGBT applications in new energy vehicles:

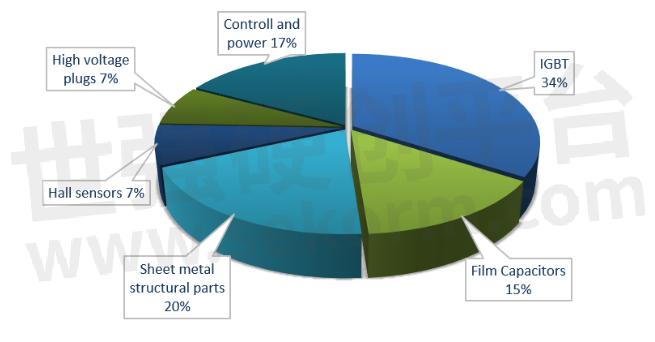

The value of IGBT, as the core device of energy conversion and transmission, accounts for about 1-2% of the cost of the whole vehicle. We use the 150KW motor controller, which is the largest in both commercial vehicle and passenger vehicle shipments, to do our analysis. The total cost of the motor controller (stand-alone version) is about $600 (RMB 4,000). Among them, the cost of IGBT is about $210 (RMB 1400), accounting for about 34% of the total cost of the motor controller. Each component accounts for:

The high proportion and high-value attributes of IGBTs, coupled with the increased risk of international trade in recent years, have prompted the development of localized substitution. With the development of the domestic IGBT industry, the device reliability is getting higher and higher, meanwhile, the cost advantage and service advantage are highlighted. Therefore, the user viscosity of IGBT localization will also climb. The prospect of domestic IGBT devices is very promising.

#2 Power Up for Electric Vehicles

At present, new energy vehicles have entered a rapid development track. As a matter of fact, its development has gradually changed from policy-oriented to market-oriented. On this basis, the key components of new energy vehicles have entered full competition. Quality assurance and cost reduction have become very important issues.

2021 was the first year of the SiC device explosion, pulling the new energy vehicle industry to do technology iteration - 400V voltage platform escalated to 800V voltage platform. Indeed, SiC MOS has an unparalleled power consumption advantage, in the period of battery life anxiety, the extra 7%~10% range that SiC devices can provide is rare and can be regardless of cost.

However, there is also bound to be a place for IGBTs on the 800V voltage platform. The mature application scenario in commercial vehicles; the low on-state voltage drops, and low switching loss brought by the IGBT7 fine trench, smaller chip area; and lower cost all determine that IGBT will be the main force of power devices on the 800V platform.

SiC cannot achieve an absolute advantage in performance, so the cost advantage of IGBT comes into play. According to the sales data statistics in December 2021, the proportion of A-class and below models is over 70%, which indicates that EVs with pricing of $15,000 (RMB 100,000) and below are still the mainstream of the industry at present. Compared with high-end models, this segment is more demanding in terms of cost.

Based on the current market price of automotive SiC-MOSFET modules, there is at least one time the cost difference between IGBTs and SiCs of the same current specification. The cost advantage of IGBTs is obvious, which means the market space will not be squeezed by SiC-MOSFETs. This will be the case in the market for passenger car motor controllers, which are price-based, and even more so in the market for commercial vehicle motor controllers, where cost is absolutely dominant.

#3 WAYON IGBT Product Planning for New Energy Vehicle Industry

At the time of laying out the IGBT industry, WAYON has already started planning for automotive modules. WAYON launches an HD package module for commercial vehicles and a VA module for logistics vehicles in Q2 to Q3 of 2022, which has the following features:

· Higher power cycle life

· Universal package design

· Higher robustness

· More stringent screening and testing process

· Better quality control process

Guided by the actual needs of our customers, WAYON provides solutions that our customers seek. The package form is as follows:

HD module dimensions are compatible with Infineon's EconoDUAL 3 package for 100KW-200KW commercial vehicles and logistics vehicle motor controllers. VA module dimensions are compatible with Infineon's HP1 package, suitable for 60KW-100KW logistics vehicle motor controllers.

- +1 Like

- Add to Favorites

Recommend

- How Does Press-fit Technology Elevate IGBT Production?

- Working Characteristics of IGBT

- Application Scope and Market of IGBT

- What is IGBT? What is Its Working Principle? What are Its Advantages?

- Renesas’ the next generation IGBT/AE5 offers high efficiency and ease of use

- The World‘s Best Performance IGBT Product That Responds to Energy Saving and High Performance of xEV

- Types and Applications of IGBT

- What is the Difference between MOS tube and IGBT?

This document is provided by Sekorm Platform for VIP exclusive service. The copyright is owned by Sekorm. Without authorization, any medias, websites or individual are not allowed to reprint. When authorizing the reprint, the link of www.sekorm.com must be indicated.