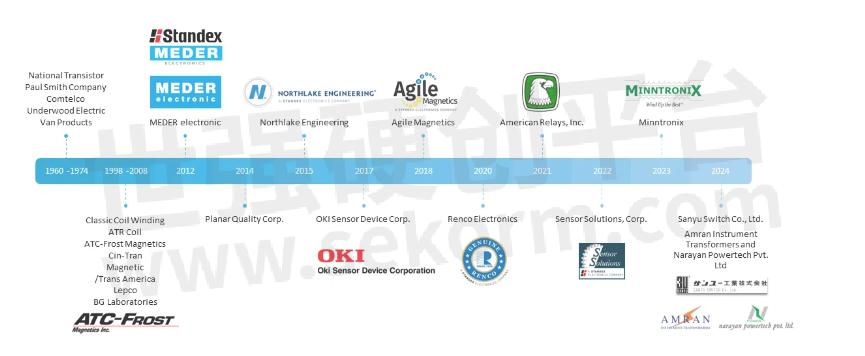

STANDEX Acquires AMRAN INSTRUMENT TRANSFORMERS and NARAYAN POWERTECH PVT., LTD.

Immediately Accretive to Revenue Growth, EBITDA Margin, Operating Margin, EPS and FCF

Amran/Narayan Grew Revenue at ~30% CAGR Over Last Three Years; Expects ~$100M of Revenue in CY 2024, with Adjusted EBITDA Margin Above 40%

Significantly Expands Presence in the Fast-Growing, High-Margin Electrical Grid End Market, Benefiting from Infrastructure Upgrades, Capacity Expansion and Data Center Demand

Standex’s Exposure to Fast Growth Markets Increases to ~25% of Sales on Pro-Forma FY 2024 Basis

Broadens Technology Platform and Capabilities to Expand Growth into Electronics’ Markets

Geographic Expansion with Engineering Expertise in India and Intellectual Property in Low to Medium Voltage Technologies

SALEM, N.H., Oct. 29, 2024 /PRNewswire/ — Standex International Corporation (NYSE: SXI) today announced that it has acquired, in separate transactions, privately-held US-based Amran Instrument Transformers and India-based Narayan Powertech Pvt. Ltd. (going forward referred to as “Amran/Narayan Group”) in cash and stock transactions. These transactions represent a combined enterprise value of approximately $462 million, comprised of 85% cash and 15% in Standex common stock for Amran Instrument Transformers and 90% cash and 10% in Standex common stock for Narayan Powertech Pvt. Ltd. The 10% share exchange related to Narayan Powertech Pvt. Ltd. is subject to India regulatory approval, which is expected to take up to six months. The cash consideration of the transactions was financed using cash-on-hand, existing credit facilities, and a $250 million 364-day term loan with existing lenders. The Company intends over the next several weeks to convert the 364-day term loan into exercise of the accordion feature under its existing credit facilities. Standex will remain committed to paying down debt and expects to reduce leverage below 1.0x net debt to EBITDA ratio within the first 24 months post-transaction.

With manufacturing locations in the United States and India, Amran/Narayan Group is a leading manufacturer of low voltage and medium voltage instrument transformers. Its custom product portfolio is specifically designed and developed in partnership with OEMs for their specific equipment related to electrical grid applications. Amran/Narayan Group’s products have been installed in over 50 countries around the world.

In calendar year 2024, Amran/Narayan Group estimates revenues of approximately $100 million with an adjusted EBITDA margin above 40%.

“As the largest acquisitions in the Company’s history, this is an exciting milestone for Standex,” said David Dunbar, President and Chief Executive Officer of Standex. “Amran/Narayan Group’s extensive low to medium voltage portfolio and engineering expertise fit within our strategy to accelerate growth in secular, fast growth end markets. The combination of Standex and Amran/Narayan Group continues Standex’s portfolio strategy of focusing our higher-margin business segments in faster-growing markets. With these acquisitions, Standex Electronics will now represent more than 50% of the Company, and we anticipate consolidated adjusted EBITDA margin expanding by over 200 basis points in the first full year as a combined company. We look forward to welcoming the entire Amran/Narayan Group team to our company.”

“Amran will operate as a key pillar of the combined companies’ low- to medium-voltage instrument transformers business,” said Bhargav Shah, Founder and President of Amran. “Both Standex and Amran have a centralized focus on long-term customer relationships and customer-specific new product development, and together, we are optimistic about our combined resources to accelerate growth in the electrical grid market.”

“The combination of Narayan Powertech and Standex creates a strong player in the transformer industry, with the ability to leverage a larger global footprint and portfolio breadth to create increased value for our customers,” added Chirag Shah, Founder and Managing Director of Narayan Powertech. “As part of the Narayan founding team, I am thrilled to continue the journey with other key team members as part of a global leader like Standex. We believe the combination will allow for expanded growth opportunities, supported by a seamless cultural fit.”

Transaction Highlights

The transactions are expected to be immediately accretive to Standex’s revenue growth, EBITDA margin, operating margin, earnings per share and free cash flow in the first full year post closing of the transactions, excluding any acquisition and integration related costs. Longer term, the combination is expected to create cross-selling opportunities given the companies’ complementary offerings.

Moving forward, Amran/Narayan Group’s founders and leadership team will remain with the combined company. Their entrepreneurial know-how, technical skills, and extensive experience across the transformer industry will benefit the combined company with its integration efforts, innovation roadmap, and future growth.

Amran/Narayan Group will be reported as part of Standex’s Electronics business segment.

Guggenheim Securities LLC is serving as financial advisor and Foley Hoag LLP and Lexygen are serving as legal counsel to Standex. Northern Edge Capital Advisors, LLC is serving as financial advisor and Chamberlain, Hrdlicka, White, Williams & Aughtry, P.C., and Khaitan & Co. are serving as legal counsel to Amran and Narayan.

Conference Call Details

Standex will host a conference call for investors today, October 29, 2024, at 10:00 a.m. ET. On the call, David Dunbar, President, and CEO, and Ademir Sarcevic, CFO, will review these acquisitions together with the Company’s first quarter financial results and business and operating highlights.

A replay of the webcast will also be available on the Company’s website shortly after the conclusion of the presentation online through October 29, 2025. To listen to the teleconference playback, please dial in the U.S. (888) 660-6345 or (646) 517-4150 internationally; the passcode is 60631#. The audio playback via phone will be available through November 5, 2024.

About Standex 关于斯丹迪斯

Standex International Corporation is a global multi-industry manufacturer in five broad business segments: Electronics, Engraving, Scientific, Engineering Technologies, and Specialty Solutions with operations in the United States, Europe, Canada, Japan, Singapore, Mexico, Brazil, Turkey, India, and China.

- +1 Like

- Add to Favorites

Recommend

- Exchange Voltage Conversion Techniques “Authentic“ Electronic Transformers

- The Voltage Regulator Diode BZT52C33 Features Precise Zener Voltage, Low Dynamic Impedance and Low Reverse Current

- High Voltage Low Profile Schottky Rectifier ST15120S Has Extremely Low Forward Voltage of 0.76V@15A for Maximum Efficiency

- The Role of Gigabit Ethernet Transformers in Fiber Optic Connectors

- Three-Terminal Low Power High Voltage Regulators SR71XXMP with High Input Voltage Up to 15V

- Bi-direction ESD Protection Diode ESDBL18VD3 with a Low Reverse Stand−off Voltage of 18V and a Low Reverse Clamping Voltage

- The Voltage Regulator Diode ZMM2V7 Features Voltage Regulation, Precise Voltage Reference, Overvoltage Protection, Low Reverse Current and Temperature Stability

- Three Terminal Low Power High Voltage Regulators SR75XXST with A High Input Voltage up to 37V and TO-92 Package

This document is provided by Sekorm Platform for VIP exclusive service. The copyright is owned by Sekorm. Without authorization, any medias, websites or individual are not allowed to reprint. When authorizing the reprint, the link of www.sekorm.com must be indicated.